Company registration in the United Kingdom offers an attractive opportunity for international entrepreneurs due to its stable economy, business-friendly policies, and global reputation. Regardless of your location, this step-by-step guide will help you register a company in the UK, outline the key requirements, and address the specific considerations for non-residents.

Benefits of UK Company Registration

The United Kingdom represents an appealing destination for global entrepreneurs looking to establish themselves in Europe and worldwide markets. The rule of law, economic stability, and convenient access to international markets make it an excellent choice for non-residents wishing to expand their business operations.

Business Without Borders: Economic Advantages of UK Company Registration

The United Kingdom creates an exceptionally favorable environment for non-residents wanting to establish a business. Among the primary benefits is access to a stable economy, which serves as an excellent foundation for expansion. A company registered in the UK opens access to international markets, including the European Union (despite Brexit) and Commonwealth countries, thanks to robust trade networks.

The Legal Environment in the United Kingdom

The UK boasts a strong legal framework that ensures clear and predictable business regulations, minimizes risks, and enhances trust among partners and clients.

Global Reputation and Business Opportunities

Companies registered in the UK are widely recognized as reliable and reputable organizations, which significantly boosts their status in competitive markets. This strong reputation serves as a springboard for forming joint ventures with leading corporations, attracting investments from businesses seeking secure opportunities, and appealing to clients who value credibility.

Step-by-Step Guide to Company Registration in the United Kingdom

Registering a company in the UK as a non-resident involves a series of straightforward and transparent procedures.

Step 1: Choosing the Right Business Structure

The first crucial step is selecting the appropriate business structure. For most non-residents, the best option is a Private Limited Company (Ltd) due to its flexibility and the advantage of limited liability for shareholders. This structure ensures a clear separation between personal and business finances, protecting personal assets in case of financial difficulties.

A Limited Company also allows multiple shareholders, making it an attractive option if you plan to expand or seek investments. Alternative structures, such as a Public Limited Company (PLC) or a Limited Liability Partnership (LLP), may be suitable for specific cases but involve more complex regulatory requirements. To make the best decision, it is advisable to discuss your business goals with an industry expert.

Step 2: Choosing a Unique Company Name

Your company name is a crucial part of your brand identity and must comply with Companies House regulations.

Criteria for an Ideal Company Name:

– Uniqueness – The name must not already be registered.

– Clarity & Relevance – It should reflect your business mission and industry.

– Legal Compliance – No duplication of existing names.

– Restrictions on Certain Terms – Words like “Royal” or “Government” require special approval.

– Memorability – A simple, easy-to-remember name enhances brand recognition.

Before registering your company, check the name’s availability using the official Companies House service.

Your company name is the first impression for clients, partners, and investors. It plays a key role in shaping your brand’s reputation and marketing strategy.

Step 3: Preparing the Required Documents for Registration

To register your company, you need to prepare several key documents. The Memorandum of Association outlines the intent to establish the company and lists its initial subscribers (shareholders). The Articles of Association define the company’s internal rules, including decision-making processes and share distribution.

Additionally, you must provide details of at least one director, shareholders, and a registered office address in the UK.

Step 4: Registering Your Company Online or via an Agent

You can submit your application directly through the Companies House website or use a formation agent.

– Online registration typically takes 24-48 hours.

– Formation agents cost more but offer expert guidance and additional services, such as tax registration or setting up a registered office address.

For non-residents, working with an agent can be especially beneficial when handling the process remotely.

Step 5: Receiving Your Certificate of Incorporation

Once your application is approved, Companies House issues a Certificate of Incorporation, officially confirming your company’s legal status. This document includes your company name, registration date, and company number.

The certificate is essential for:

– Opening a corporate bank account

– Signing contracts

– Verifying your company’s legitimacy with partners.

“The UK market offers immense opportunities for international businesses, and we’ve helped numerous companies take this step. Transparent regulations, a prestigious jurisdiction, and access to global payment systems make the UK an attractive choice for entrepreneurs. Our experience shows that even complex cases can be resolved with the right approach.”

— Liubov Voitsekhovska,

CEO, Taxus Law & Finance

Key Requirements for UK Company Registration

Here’s what non-residents need to know.

Registered Office Address in the UK

Every UK company must have an official registered office address, which is used for receiving official correspondence, such as tax reminders. Non-residents without a physical presence in the UK can use a virtual office or registered address service to meet this requirement.

Information About Directors and Shareholders

You need at least one director, who can be a non-resident, along with details of all shareholders. Required information includes full names, addresses, and nationalities to ensure accuracy and avoid processing delays. Some company details are made publicly available via Companies House.

Memorandum and Articles of Association

These foundational documents are mandatory.

– Memorandum of Association – A formal statement of intent to establish the company.

– Articles of Association – A set of rules governing the company’s management and operations.

You can use standard templates provided by Companies House or tailor them with professional legal assistance to suit your business needs.

Costs and Fees for Registering a Company in the UK

Understanding the cost of registering a company in the UK is essential for planning and budgeting.

UK Company Registration Fees for 2025

As of 2025, online company registration through Companies House remains an affordable and cost-effective option. However, paper-based applications come with higher fees due to additional processing requirements. Depending on the chosen method and extra services, additional costs may apply.

Official Registration Fees

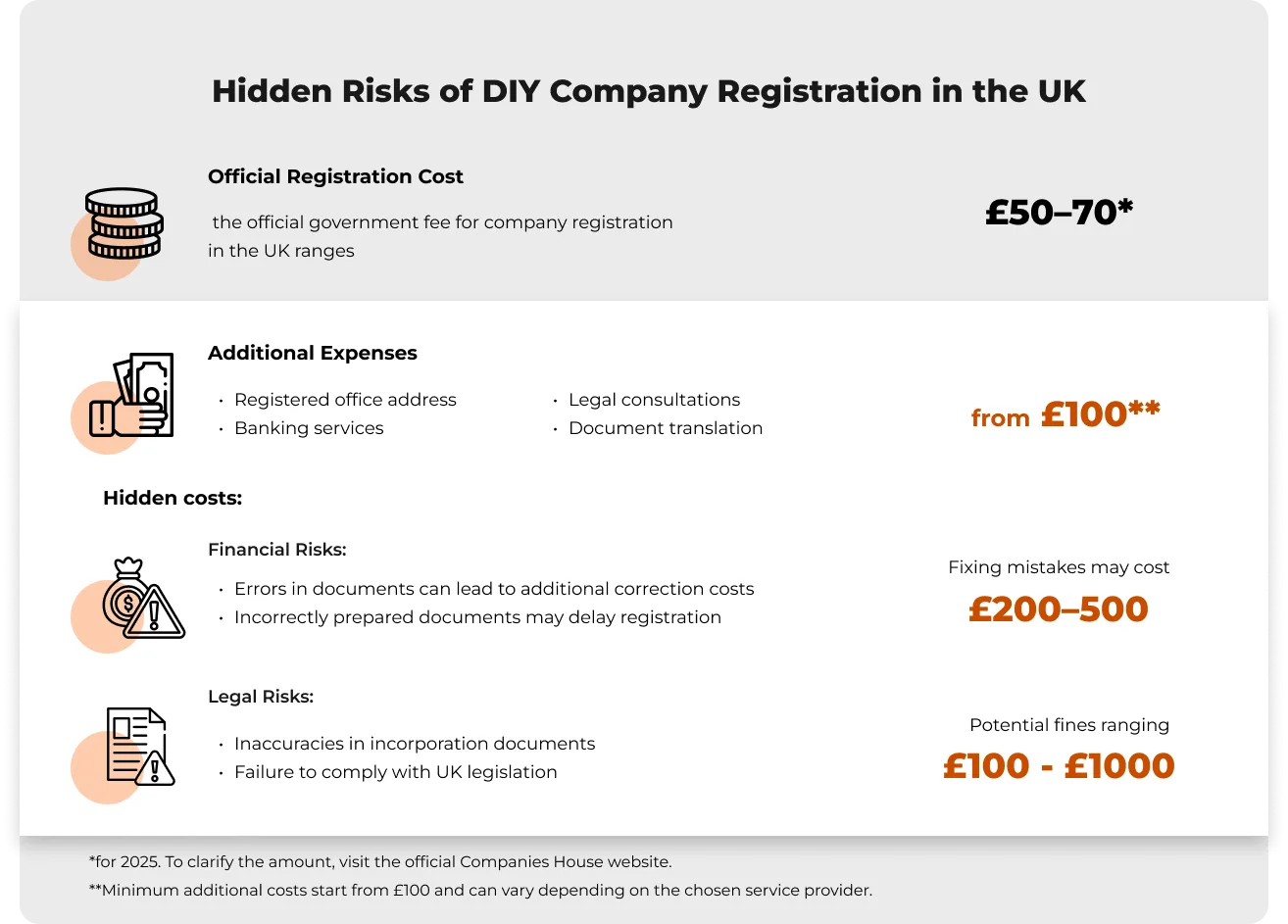

As of 2025, the statutory fee for company registration ranges from £50 to £70. To confirm the exact amount, visit the official Companies House website.

While registering a company in the UK may seem straightforward, without professional support, you risk unexpected costs and bureaucratic hurdles.

Hidden Risks of DIY Registration

Financial Risks:

- Errors in documentation can lead to extra correction fees

- Incorrectly filed documents may delay registration

- Correction costs can range from £200 to £500

Legal Risks:

- Inaccuracies in incorporation documents

- Non-compliance with UK legislation

- Potential fines ranging from £100 to £1,000

For the most up-to-date fees, always check the Companies House website before submitting your application, as charges may change periodically.

Additional Costs

Beyond the standard company registration fee, foreign entrepreneurs may encounter additional expenses. For instance, the requirement for a registered office address often involves regular payments, which vary depending on the service provider and may include mail forwarding services.

The cost of opening a corporate bank account also varies depending on the chosen bank and account type.

If your company’s annual turnover exceeds the VAT threshold, VAT registration becomes mandatory, leading to extra administrative costs.

Additionally, non-residents may require legal or translation services, especially if document preparation or verification is needed to comply with UK standards.

How Long Does It Take to Register a Company in the UK?

Registering a company in the UK can be a quick and convenient process, especially when applying online. If you need a fast business launch, it’s essential to understand your options.

Standard Processing Time: Online vs. Paper Application

- Online registration via Companies House is the fastest and most efficient way to set up a company. If all documents are correctly prepared, the process typically takes 24 to 48 hours—an ideal option for entrepreneurs looking to start operations as soon as possible.

- Paper applications take longer, as documents are manually processed. This method usually requires 5 to 7 business days, so it’s important to factor this into your business timeline.

Expedited Registration Options

For businesses needing an urgent setup, Companies House offers same-day registration for an additional fee. If you submit your application before 11 AM, it may be processed and approved within 24 hours.

Company Registration in the UK for Non-Residents

Registering a company in the UK remains accessible to non-residents, offering international entrepreneurs favorable conditions for doing business. While the process is relatively straightforward, it’s crucial to consider key legal and regulatory requirements to ensure a smooth company setup.

Can I Set Up a UK Limited Company If I Live Outside the UK?

Physical presence in the UK is not required to register a company. However, there are essential requirements to meet:

- A registered UK address is mandatory for official correspondence and legal purposes.

- Company owners and directors must comply with UK corporate governance regulations to ensure proper business operations.

Opening a UK Business Bank Account as a Non-Resident

One of the main challenges for non-residents is opening a corporate bank account. UK banks follow strict anti-money laundering regulations, which can make the process more complex. To open a business account, you will typically need company registration documents, director identification, in some cases, proof of a UK address.

If traditional banks are not a viable option, there are alternative solutions—such as digital banking platforms that provide international business accounts with UK bank details. This allows companies to manage transactions efficiently without requiring a physical presence in the UK.

Verifying Your UK Company Registration

Once your company is successfully registered in the UK, it is essential to verify its official status and authenticity. This ensures trust among partners, clients, and regulatory authorities while guaranteeing compliance with legal requirements.

How to Check Your Company Registration Status

You can verify a registered company’s official status using the Companies House online service. Simply enter the company name or registration number to access up-to-date information on its activity and regulatory compliance.

Confirming the Registration Number

A company registration number (CRN) is a crucial identifier for all official business transactions. You can confirm its validity through the Companies House registry. A correct CRN validates the company’s legitimacy and is essential for contract signing, opening bank accounts, and conducting international business.

Regularly checking your company’s status helps avoid potential legal or financial risks and ensures smooth business operations in the UK.

Frequently Asked Questions (FAQ)

Can I register a company in the UK for free?

— No, company registration in the UK requires a mandatory fee payable to Companies House. The standard online registration fee is relatively low, while paper-based applications and expedited processing come at a higher cost. Additional expenses may arise for legal services, document preparation, and registered office rental.

What Is the Difference Between Online and Offline Registration?

— Online registration is the fastest and most convenient option, typically taking 24–48 hours if all documents are correctly submitted. Offline registration involves paper-based application submission and manual processing, which can take 5 to 7 working days. Additionally, online applications reduce the risk of errors due to automatic validation checks before submission.

Is a VAT number required for company registration in the UK?

— No, obtaining a VAT number is not mandatory for company registration in the UK. However, if your annual turnover exceeds the threshold (currently £90,000), VAT registration becomes compulsory. Businesses can also opt for voluntary VAT registration, which allows reclaiming VAT on business expenses, enhances credibility with partners, and may simplify tax procedures if rapid growth is expected.

Can I Register a UK Company from India, Pakistan, or Other Countries?

— Physical presence in the UK is not required to register a company. However, there are essential requirements to meet:

- A registered UK address is mandatory for official correspondence and legal purposes.

- Company owners and directors must comply with UK corporate governance regulations to ensure proper business operations.

The registration process for non-residents is almost identical to the standard procedure. Regardless of your place of residence, you will need to submit the required incorporation documents, including the Memorandum and Articles of Association. It’s essential to ensure in advance that your company’s structure and details comply with UK legal requirements.

Intellectual property is a major catalyst for innovation and progress in the modern world. It stimulates creativity, encourages investment in research and development, and rewards intellectual effort. However, in the context of rapidly growing digital transformation, intellectual property faces challenges that may put its protection and use at risk.

Modern technologies are changing the paradigm of relations in the field of intellectual property, requiring new approaches to legal regulation and protection of owners’ rights. The digital infrastructure opens up unlimited opportunities for the creation, preservation, and distribution of intellectual works, while at the same time, it increases the threats of theft, piracy, and unauthorized use.

The development of international treaties and conventions is becoming a key aspect of the intellectual property strategy aimed at ensuring fair remuneration and encouraging innovation.

In this article, we will review current challenges and trends in the field of intellectual property protection and analyze key aspects of legal regulation by national and international authorities.

UK Trademark Registration and Protection: Complete Legal Guide

Neither registering your company name with Companies House nor owning a domain name for your website gives you the right to prevent others from using your trademark. Therefore, you must pay special attention to protecting your intellectual property when launching in the UK.

A trademark is a sign that helps to identify the goods or services of one business from those of other businesses. It can be a word, logo, phrase, color, or even a smell that allows consumers to recognize your product or service.

But why is it so important to register your trademark?

- Registering a trademark gives you exclusive rights to use it in the UK. This allows you to protect your brand from unauthorized use or counterfeiting by other companies.

- A registered trademark increases consumer confidence in your brand and can help to increase sales through improved recognition.

- Owners of registered trademarks have the right to apply to the court to protect their rights, which may result in financial compensation and injunctions against infringers.

Note: A brand right in the UK (in the absence of registration) can be created by using a brand for a long period, which contributes to the formation of goodwill. This can allow the owner to protect its IP rights and apply to the court to prevent third parties from using an identical or very similar brand. However, this approach has disadvantages, such as its uncertainty and a heavier burden of proof. However, it is hard to deny that this practice takes place.

The trademark registration process in the UK includes the following steps:

- Examination: UKIPO examines the application within 2 weeks after it is filed.

- Search in the UKIPO register: A search for similar trademarks is conducted in the UKIPO database.

- Publication of opposition: If the application is accepted and eligible for registration, it is published for opposition.

- Registration: If no opposition is received, the trademark is registered.

As for the territorial aspect, a trademark registered in the UK protects your IP only in the United Kingdom. Therefore, if you want to protect your brand outside the country, you must either register a trademark in each country separately or use European and international instruments.

As for international protection, you can apply for trademark registration in countries that have signed the Protocol Relating to the Madrid Agreement Concerning the International Registration of Marks.

The Protocol Relating to the Madrid Agreement Concerning the International Registration of Marks is administered by the World Intellectual Property Organization (WIPO), located in Geneva, Switzerland. You can find a list of member countries that an international application can cover on their website.

An international application must be based on an existing trademark application or registration in one of the member countries. If you are filing through a UK office, your international application must be identical to the UK trademark application or registration. You can file your international application at the same time as your UK application or at a later date if you wish.

Note: Please note that the designation of the United Kingdom in international applications filed on or after January 1, 2021, automatically entitles you to IP protection in Gibraltar without the need to apply for registration of your trademark in this territory.

To protect your brand in the EU, you can apply for a European Union Trademark (EUTM) through the European Union Intellectual Property Office (EUIPO) located in Alicante, Spain.

In terms of validity, a UK registration can be renewed every 10 years for a fee and can last indefinitely as long as it is used and renewed.

Patent Registration in the UK: Application Process and Protection Features

A patent is an important legal tool for protecting innovations and technological advances. The patent system provides legal protection for new inventions, allowing their inventors to control the use of their developments in the UK.

A patent grants its holder the exclusive right to use, manufacture and sell the invention for a certain period of time, usually up to 20 years. This right is granted provided that the invention is new, has an inventive step and is industrially applicable.

In general, the patent term is valid for 5 years after registration, but it may be extended for up to 20 years.

What can be patented?

Your invention must be:

- new – it must not have been made public anywhere in the world, such as being described in a publication.

- innovative – for example, it cannot be an obvious change to something that already exists.

- either something that can be made and used, a technical process, or a method of doing something.

Note: Patents can protect inventions that are not yet in the public domain. It is important to keep inventions secret and disclose information about them only under an NDA to preserve their patentability.

Procedure.

Obtaining a patent can be a complicated process, and without professional assistance, it will be very difficult to achieve. The procedure may take several years.

If you are sure that your invention is new and meets the requirements for patenting, you can apply for a patent. The process will look like this:

- Prepare detailed documentation that fully and clearly describes your invention.

- Submit these documents to the IPO.

- After applying, the IPO will examine to determine the novelty and inventive step of your invention (this process is called “search”).

- Your application will be published in full approximately 18 months after filing.

- Subsequently, the IPO will conduct a substantive examination of your application to determine whether it is patentable. This process may take several years.

- You may need to amend the application in accordance with the recommendations of the IPO. Your patent will be granted only after all the issues raised during the examination have been resolved.

What about protecting your invention outside the United Kingdom?

The Patent Cooperation Treaty (PCT) helps to protect your invention internationally. The treaty currently has 157 signatories.

By filing a single international patent application under the PCT with the help of WIPO, applicants can simultaneously obtain protection for their inventions in a large number of countries.

Note: In some cases, you may need permission to file a patent application abroad if your invention relates to technologies that may harm national or public security.

These may include the following categories of inventions:

- Atomic Energy

- Airborne Anti-submarine Warfare (ASW)

- Military Aircraft and Helicopter Construction and Design

- Aircraft Engineering

- Aircraft Launching, Take-off and Landing Devices

- Airfields, Runways, Landing Decks and Tracks

- Armor and Protective Devices

- Chemical and Biological Warfare, etc.

Industrial Design Protection in the UK: From Registration to Legal Defense

A design is an important element of intellectual property that protects the appearance of products from being copied or imitated. Registration of a design in the UK gives the right holders the right to prohibit others from using similar designs without permission.

A design is a new and original product design that defines its appearance. It can be a shape, ornament, drawing, or a combination of these elements. It is important that a design doesn’t have to be functional – it should only relate to the aesthetic side of the product.

Designs registered in the UK cover England, Wales, Scotland, Northern Ireland, and the Isle of Man.

A design can’t be registered if:

- It contains offensive materials, foul language, or pornographic images.

- Designs for which permission is required, for example, using national flags.

- Designs that use official emblems.

- Functional constructions.

What are the advantages of registering a design?

- Registration provides legal protection of the design against unauthorized use or copying.

- The owner of the registration has the right to prohibit others from using similar designs.

- A registered design can be a valuable asset for a company, which can be beneficial when sold or licensed.

The industrial design registration procedure can be divided into the following stages:

- Search. Before filing an application, you should search the design register to check for identical designs. Or you can request a search of designs in the register from the Intellectual Property Office.

- Preparation. You must prepare up to 12 illustrations that fully describe your design and meet the requirements for illustrations while preparing the application for registration.

- Submission. You have to pay a fee when submitting your application. The amount of the fee depends on the number of designs you register, not the number of illustrations.

- Review and registration. The IPO reviews the application within 2 weeks. If the IPO has any comments on your application, it provides its recommendations and 2 months for corrections. If there are no comments or corrections, your design is registered.

- Completion of registration. After the registration of the design, the IPO publishes your design in the Journal of Registered Designs and provides you with a certificate of registration.

Note: If your application is rejected, the IPO will notify you of this, indicating the reason for the rejection. The decision to reject an application for design registration may be appealed to the Appointed Person or to the High Court of England and Wales, the Court of Session of Scotland, or the High Court of Northern Ireland.

UK Copyright Law: Automatic Protection for Creative Works and Innovations

Copyright regulates the relations arising from the creation and use of works of science, literature, and art, and protects the personal (non-property) and property rights of authors and their right holders.

Copyright protection is granted to you automatically – you don’t need to file any applications or pay any fees. There is no special register of copyrighted works in the UK.

Copyright protection is automatic when you create:

- Original literary, dramatic, musical, or artistic works, including illustrations and photographs.

- Original written works not related to literature, such as software, web content, or databases.

- Sound recordings and musical compositions.

- Cinematographic and television works.

- Broadcasts.

- Layout of publications containing written, dramatic, or musical works.

You can mark your work with the copyright symbol (©), your name, and the year of creation.

Your work may be protected by copyright in other countries through international agreements, such as the Berne Convention for the Protection of Literary and Artistic Works.

Protection of Trade Secrets in the UK: Legal Mechanisms and Confidentiality Tools

Trade secrets protect business information, including data such as customer lists, business plans, financial forecasts, supplier agreements, software algorithms, technological developments, and other internal company documents. There is no separate register for this purpose. In the United Kingdom, trade secrets can be protected under the general law of confidentiality, which provides for keeping information secret and disclosing it only to those who have signed NDAs.

How to protect your intellectual property?

- Intellectual property audit.

Regular review of intellectual property assets is important to ensure that your rights are properly protected. This is the so-called intellectual property audit, which allows you to check whether the protection of your assets is up to date. Taxus Law&Finance can assist you in conducting this audit by providing advice on the scope and condition of your intellectual property portfolio. We will help you understand whether your portfolio corresponds to the actual assets you own and use, what additional rights you may have, and how to effectively protect and enforce these rights.

- Licensing and transfer of intellectual property rights.

Intellectual property rights can be important intangible assets and can be licensed, transferred, sold, or used to attract investment.

Introduction

The UK banking system has continued to evolve rapidly, and by 2025, the shift towards digital and alternative banking solutions has become even more pronounced. Traditional banks, while still relevant, are increasingly being challenged by innovative financial technologies and services that offer greater flexibility, lower costs, and enhanced convenience. For businesses, especially small and medium-sized enterprises (SMEs), these alternatives have become indispensable tools for managing finances in a fast-paced, globalized economy.

In 2025, the demand for bank alternatives continues to grow, driven by the need for more efficient, cost-effective, and user-friendly financial solutions. From digital accounts to multi-currency platforms, businesses now have access to a wide range of services that were once the exclusive domain of traditional banks. In this article, we will explore the best alternatives to traditional banking in the UK in 2025, examining their key features, advantages, and disadvantages, and how they can replace traditional banking services in various aspects of financial management.

Key Facts About Bank Alternatives in 2025

- The Growing Popularity of Financial Solutions

By 2025, the popularity of bank alternatives has reached new heights, with businesses and individuals alike embracing digital financial platforms. The ability to handle all transactions online via mobile apps and web platforms has become a standard expectation. The convenience of managing finances without the need for physical bank branches has made these alternatives particularly attractive, especially for tech-savvy entrepreneurs and businesses with international operations.

- Digital and Virtual Accounts

Digital accounts have become the cornerstone of modern banking alternatives. These accounts allow users to perform standard financial operations, such as transfers, bill payments, and salary disbursements, without the need for a traditional bank account. Virtual cards, which provide enhanced security and convenience for online transactions, have also become a staple for businesses looking to streamline their financial operations.

- Financial Technology (Fintech)

Fintech continues to be a driving force behind the evolution of banking alternatives. In 2025, fintech platforms offer a wide range of services, including loans, investment opportunities, and other financial products that were once only available through traditional banks. These platforms are not only convenient but also cost-effective, making them a popular choice for businesses looking to optimize their financial management.

- Low Fees and Convenience

One of the main advantages of banking alternatives in 2025 is the absence of or significantly lower fees for account maintenance and transactions. Many platforms offer free account opening and user-friendly mobile apps, allowing businesses to manage their finances anytime, anywhere. This has made bank alternatives particularly appealing to startups and small businesses with limited budgets.

- Adaptation to User Needs

In 2025, many platforms have become highly specialized, catering to specific user needs. For example, some platforms focus on providing services for small businesses, while others offer products for individuals and companies that do not have access to traditional banking services. This ensures greater inclusivity and accessibility for different segments of the population.

- Security and Data Protection

With the rise of digital banking, security and data protection have become paramount. In 2025, most platforms use advanced security systems, such as biometric authentication, two-factor authentication, and end-to-end encryption, making these services highly reliable for users. Additionally, many platforms are regulated by financial authorities like the FCA (Financial Conduct Authority), ensuring that they meet strict security and compliance standards.

The Best Bank Alternatives in the UK for Businesses in 2025

- Starling Bank for Business

Starling Bank remains a top choice for small businesses in 2025. It offers a professional business account with features like multi-currency accounts, international transactions, and automated financial processes. The mobile app allows businesses to track expenses, manage taxes, and prepare financial reports. With no fees for account opening or maintenance, Starling Bank is a cost-effective option for businesses.

- Revolut for Business

Revolut continues to be a powerful tool for businesses, offering multi-currency accounts, low-cost currency exchange, and international money transfers. In 2025, Revolut has expanded its services to include advanced financial tools, such as integration with accounting software and employee benefit cards, making it ideal for businesses with international operations.

- Monzo Business

Monzo for Business remains a popular choice for small businesses, offering quick account opening, expense tracking, and cash flow management. The platform integrates with other accounting applications, making it easy for businesses to automate financial processes. Its user-friendly interface and mobile app make it a convenient option for entrepreneurs.

- Tide

Tide continues to be a go-to digital banking service for small and medium-sized businesses in the UK. In 2025, Tide offers free business checking accounts with no fees for account opening or maintenance. The platform provides simple tools for expense management, invoicing, and real-time financial data review, making it an excellent choice for entrepreneurs who value simplicity and accessibility.

- Monese for Business

Monese for Business remains a strong contender for startups and international companies. In 2025, Monese offers quick account opening, multi-currency accounts, and low-cost international payments. The platform is particularly useful for businesses operating across Europe and beyond, offering free transfers between accounts.

- Wise for Business (formerly TransferWise)

Wise continues to dominate the market for international money transfers and currency exchange. In 2025, Wise offers corporate multi-currency accounts with low fees for international transfers and foreign currency exchange. This service is ideal for businesses with global clients or suppliers, offering flexibility and cost savings.

Why Should You Choose a Bank Alternative for Business in 2025?

- Lower Service Costs

One of the primary reasons businesses prefer alternatives to traditional banks is the significant reduction in service costs. In 2025, platforms like Monzo and Revolut for Business continue to offer low or no fees for account opening, maintenance, and international transfers, allowing businesses to save money and reinvest in growth.

- Flexibility and Convenience

Bank alternatives provide more flexible and convenient conditions for conducting business. Most platforms operate online, enabling businesses to manage their finances anytime, anywhere using mobile apps and web platforms. This is particularly advantageous for companies with multiple offices or international partnerships.

- Innovative Business Tools

Many financial alternatives offer innovative business tools that traditional banks cannot match. For instance, services like Revolut allow companies to open multi-currency accounts, execute international money transfers without additional fees, and integrate banking services with accounting systems. These features simplify financial management and enable businesses to operate more efficiently.

- Improved Customer Service

Bank alternatives are known for their high-quality customer support. In 2025, these services provide fast and convenient access to support via chat, phone, or email, eliminating the need for in-person visits to bank branches.

- Inclusivity and Accessibility for Startups

Traditional banks often have complex account-opening procedures for new companies and startups. In 2025, alternative banks simplify registration and provide access to financial services without requiring a credit history check, enabling startups to launch quickly.

- Transparency and Financial Management

Bank alternatives ensure a high level of transparency in financial management. Through mobile apps and online platforms, business owners can view all financial transactions in real-time, track expenses and revenues, and set up automated alerts and reports.

- Multi-Currency Functionality

Many alternatives to traditional banks, such as Revolut and Wise, allow businesses to manage multiple currencies within a single account. This is crucial for companies operating in international markets, simplifying transactions with foreign clients and partners.

Comparison of Bank Alternatives for Business in 2025

The choice of a bank alternative depends on many factors: business size, required features, international operations, budget, etc. Below is a comparison table of the most popular options for business clients in the UK in 2025.

| Platform | Key Features | Advantages | Disadvantages |

| Starling Bank for Business | Free business accounts, multi-currency accounts, integration with accounting software, mobile app. | No commissions for basic operations, ease of financial management, convenience for small businesses. | It does not provide all the additional features that large traditional banks have. |

| Monzo for Business | Free invoices, intuitive interface, convenience of a mobile application, integration with other accounting applications. | Easy to use, quick account opening, good customer support. | Limited features for more complex financial transactions, such as multi-currency transactions. |

| Revolut for Business | Multi-currency accounts, currency exchange with low commissions, the ability to receive premium cards, integration with accounting systems. | Low fees for international transfers, additional financial instruments for business. | The cost of premium plans can be prohibitive for small companies. |

| Tide | Free business accounts, easy expense management, the ability to create invoices and receive payments through a mobile app. | Simple and convenient accounts, no fees for basic transactions. | Limited number of features for large enterprises. |

| Monese for Business | The ability to open an account without a British address, multi-currency accounts, a convenient mobile application for international transactions. | Ease of opening an account for startups, international payments without high fees. | Limited options for integration with other business systems. |

| Wise for Business | International transfers with low fees, multi-currency accounts, transaction speed. | The lowest fees for international transfers, the speed of transactions. | Does not provide full-fledged banking services (credit lines, deposits, etc.). |

This table allows you to visually compare different platforms in terms of key features, advantages, and disadvantages. You can choose the platform that best suits your business needs, considering the importance of each aspect.

FAQs About Bank Alternatives in the UK in 2025

What is a bank alternative?

A bank alternative is a financial platform that provides services similar to traditional banks but through online platforms and mobile apps. They allow businesses to open accounts, make payments, conduct international money transfers, and track expenses.

What are the benefits of bank alternatives for businesses?

- Cost Savings: Low or no fees for account opening and maintenance.

- Flexibility and Convenience: Manage finances anytime, anywhere.

- Innovative Tools: Multi-currency accounts, quick international transfers, and integration with accounting software.

Is it safe to use a bank alternative?

Yes, most UK-based alternatives are licensed and regulated by financial authorities like the FCA (Financial Conduct Authority), ensuring the safety and reliability of financial operations.

What are the limitations of using alternative banks?

- Limited Services: Some alternatives lack services like credit lines or deposit accounts.

- Limited Cash Access: Some platforms impose restrictions or fees for cash withdrawals.

- Unfamiliar Approach: Businesses accustomed to traditional banks may need time to adapt to online interfaces.

How to choose the best bank alternative for your business?

Consider factors like international trade, business type, and required features. For example, if your business operates globally, choose a platform with multi-currency accounts and low international transfer fees.

Can bank alternatives be used for large companies?

Yes, platforms like Revolut and Starling offer packages tailored for large companies, including multiple accounts, employee cards, and multi-currency transactions.

Can I get a loan through a bank alternative?

Most alternatives do not offer traditional credit lines, but some, like Revolut, may offer leasing or credit products for businesses.