Trust in fintech: What Wirecard’s collapse teaches fintech industries today

Scandals in the fintech industry have once again taken center stage thanks to the Netflix documentary Skandal! Bringing Down Wirecard (7.1/10 on IMDb), which I recently watched as part of a work assignment. This story of the downfall of a German payments giant is not just a dramatic tale of fraud but a mirror reflecting systemic issues that continue to threaten the industry. But is it only about the past? Questions of trust in fintech companies, their transparency, and regulatory compliance remain as relevant as ever. Has the industry learned its lessons, or are we stepping on the same rakes again?

Wirecard: Not Just a Scam, but a Systemic Failure

In 2018, Wirecard was a star of Germany’s DAX 30, valued at €24 billion and seen as a symbol of fintech’s future. The company promised a revolution in digital payments, but behind the glossy façade lay a disaster: €1.9 billion supposedly held in Philippine bank accounts simply did not exist. As Financial Times journalist Dan McCrum stated in the documentary: “The problem wasn’t that the money disappeared. The problem was that it was never there.”

Fake financial reports, shell companies, and even nonexistent offices at registered addresses were propped up by the charisma of CEO Markus Braun and the manipulations of COO Jan Marsalek, who vanished after the collapse (rumored to be hiding in Russia or Belarus). Why was this not just the failure of one company but a breakdown of the entire system? The market chased rapid growth without scrutinizing the foundation. Investors ignored red flags: dubious reports, insider complaints, and data discrepancies. Germany’s Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, or BaFin) not only failed to act on warnings but accused Financial Times journalists, who spent years unraveling the scam. As BaFin admitted in 2020 after the scandal: “BaFin lacked sufficient supervisory powers over Wirecard AG as a financial holding.” This meant that while BaFin oversaw Wirecard Bank AG, Wirecard AG, classified as a technology company owning the bank, fell outside its supervisory scope since it was not designated as a financial holding.

Dan McCrum and his team, despite threats, cyberattacks, and legal pressure, exposed the truth, showing that without independent oversight, even prominent brands can be empty shells. Wirecard proved that if the system blindly trusts ambition, history can repeat itself.

Industry Response

The Wirecard collapse catalyzed change. European regulators tightened requirements for fintech companies, introducing stricter AML (anti-money laundering) policies and third-party audits. Meanwhile, journalistic investigations, like those by the Financial Times, became a vital tool, forcing the industry to rethink its standards. Insiders—employees and auditors—also play a significant role, signaling internal issues and helping to identify risks before they escalate.

But is this enough? Many fintech companies chase rapid growth while shying away from maturity—meaning clear business models, transparent reporting, and compliance with licensing requirements. This desire to soar without a solid foundation continues to create risks.

Kevin: Ambition and Early Warning Signs

These reflections lead to Kevin, a Lithuanian startup embodying the modern fintech landscape. Founded in 2017, Kevin specializes in infrastructure for direct bank transfers (A2A). Their model bypasses third-party aggregators, offering proprietary bank connections with a focus on mobile payments and POS systems. Over the years, the startup raised $96.7 million from investors like Accel and Eurazeo, with its latest round in May 2022. Notably, Kevin processed all utility payments in Latvia, showcasing the scale of its ambitions. This achievement highlights how a small company can take on significant operational tasks, competing with larger players.

But rapid growth comes with challenges. In July 2024, Kevin, once considered Lithuania’s next unicorn, faced a ban from the Bank of Lithuania on onboarding new clients due to delays in submitting annual reports, alongside the appointment of a temporary overseer to monitor operations. According to the bank, the reasons included late submission of audited financial statements, failure to provide auditors with necessary information, non-compliance with capital adequacy requirements, and inadequate internal controls (Announcement on the official Bank of Lithuania website — www.lb.lt, dated 25.07.2024). Kevin’s press office stated they were fully cooperating with the Bank of Lithuania and taking immediate steps to improve internal procedures. However, by September 2024, Kevin announced bankruptcy. The Vilnius District Court noted in its ruling: “The court finds that the company’s continued operations are no longer financially viable given the extent of unfulfilled obligations and non-compliance with regulatory requirements” (as reported by LRT.lt). The Bank of Lithuania revoked Kevin’s payment institution (PI) license. By the time of bankruptcy, Kevin’s accumulated tax arrears for social insurance, starting from April 2024, reached approximately €440,000.

Unlike Wirecard, where fraud was systemic, Kevin’s situation appears less severe—more a matter of operational compliance than a large-scale scam. Yet, parallels exist: both cases feature explosive growth, investor trust, and regulatory scrutiny. However, Kevin, unlike Wirecard, shows openness to cooperating with regulators, avoids secrecy, and does not conceal its operational structure. The scale and transparency of their response to the issue are key factors distinguishing these cases. Wirecard’s attempts to silence problems mimicked stability until the end, whereas Kevin still has a chance to pass audits, restore trust, and prove its viability in challenging conditions.

Why Hasn’t the Market Learned?

Wirecard and Kevin reveal that the fintech industry still grapples with trust. The market loves success stories but often underestimates the importance of independent oversight. A clear business model, transparent reporting, and robust AML processes are not mere formalities but the bedrock of stability. Why, then, do new cases like Kevin emerge? Perhaps because investor pressure and competition for clients push companies to rush, sacrificing “boring” aspects like compliance.

A question for you: what metrics do you consider when choosing a fintech partner or opening an account? How do you assess their reliability? It’s not just about sleek apps or low fees but about reputation, licenses, and a history of regulatory and partner collaboration. Wirecard seemed unshakable but fell due to the absence of these fundamentals. Kevin has a chance to recover, but only if it prioritizes transparency.

How to Choose a Reliable Payment Institution: A Practical Checklist

The Wirecard and Kevin cases are a stark reminder: selecting a payment institution demands thorough vetting. To mitigate risks, use the checklist below to evaluate payment institutions.

✅ Jurisdiction

- Choose a payment institution in a reputable, regulated jurisdiction with a robust fintech ecosystem (e.g., EU, UK, etc.).

✅ Licensing

- Verify the payment institution’s active license (EMI, PI, crypto) on the relevant regulator’s website (e.g., FCA in the UK, Bank of Lithuania, etc).

- Investigate whether the institution has faced fines or regulatory violations.

✅ Privacy and Cybersecurity

- Review the privacy policy to understand how the institution handles and protects your personal data.

- Ensure two-factor authentication (2FA) is available for secure account access.

✅ Reputation and Transparency

- Research the institution’s reputation through news, independent client reviews on Trustpilot, Reddit, or forums.

- Find out how long the company has been operating (a longer track record may indicate stability).

- Verify the existence of physical offices by checking photos on the company’s website, addresses on Google Maps, or profiles on LinkedIn.

- Determine the number of employees via LinkedIn or official sources to assess the company’s scale.

- Look for information about the institution’s real partners (often listed on their website).

✅ Services and Fees

- Ensure the institution’s services meet your needs: payment types, currencies.

- Check the lists of countries and business types the institution serves.

- Clarify fee structures: whether there’s a fee for account opening, if fees are refundable in case of application rejection, and what commissions or charges apply.

✅ Accessibility and Support

- Confirm whether accounts can be opened online or require an in-person visit, and obtain a clear list of required documents.

- Ask if a dedicated manager is provided and if support is available 24/7.

- Verify whether the institution offers a mobile app and if it’s user-friendly for your operations.

✅ Financial Security

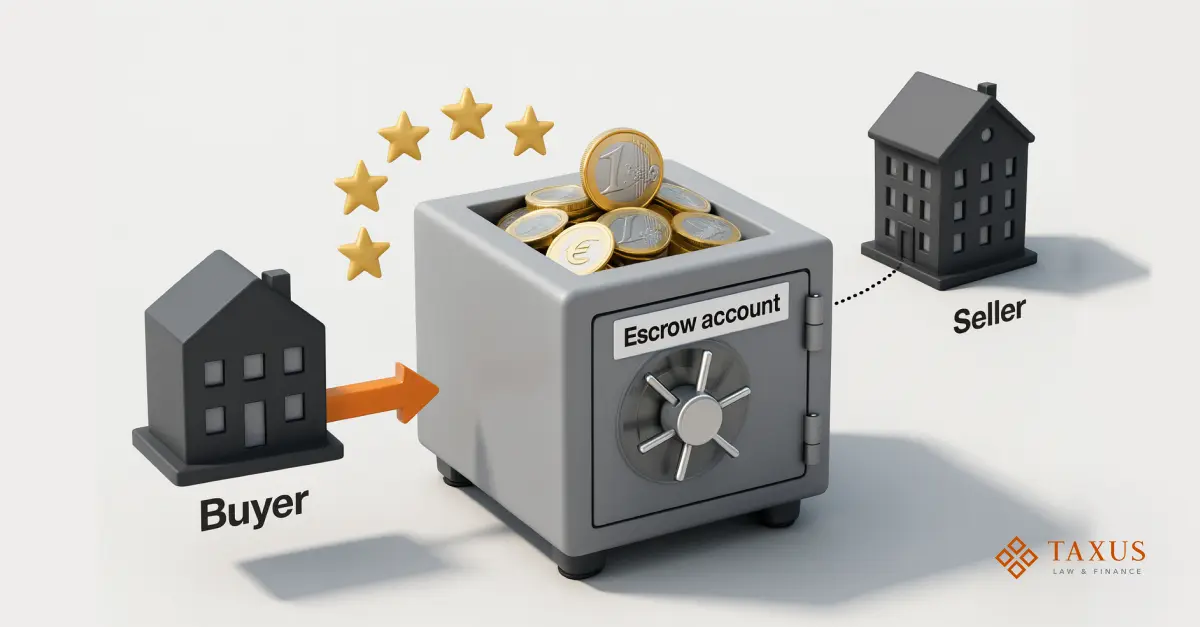

- Ensure client funds are held in segregated accounts, separate from the company’s operational funds.

- Understand the policy on fund freezes and the conditions under which they apply.

- Check if funds are guaranteed up (to €100,000 — a standard for EU institutions under EU directives).

✅ Operational Limits

- Inquire about restrictions on incoming or outgoing payments, such as limits on amounts or frequency.

Conclusion: Trust as Fintech’s Currency

Skandal! Bringing Down Wirecard is more than a fraud story — it’s a reminder that fintech thrives on trust. Journalists, insiders, and even competitors play a critical role in keeping the industry accountable. For companies like Kevin, it’s an opportunity to learn from others’ mistakes and strengthen their processes. For us, as market participants, it’s a prompt to ask: are current regulations sufficient to prevent new scandals? How do we balance innovation and responsibility?

These questions deserve discussion. What are your thoughts — how do we build a fintech industry that inspires trust?

Looking for a reliable payment processing system?

Order selection of a payment solution.