Cyprus Bank Account For non Residents

V. Hladush

Cyprus, an island nation in the Mediterranean Sea, is an attractive destination for opening an offshore bank account. With its stable economy, favorable tax regime, and membership in the European Union, Cyprus offers a secure and convenient environment for managing your finances.

Note: An offshore bank account is an account opened in a country where you do not reside.

| Advantages | Disadvantages |

| Stable economy and banking system | The account opening process may be more complex for non-residents |

| Favorable tax regime | Some banks may require a minimum deposit |

| Access to the EU single market | Fees may be charged for international transactions |

| Strict confidentiality rules | Reporting requirements may be more complex for companies |

| Wide range of banking services | Some banks may require an in-person visit to open an account |

| Professional asset management | There may be cultural and language barriers when communicating with bank officials |

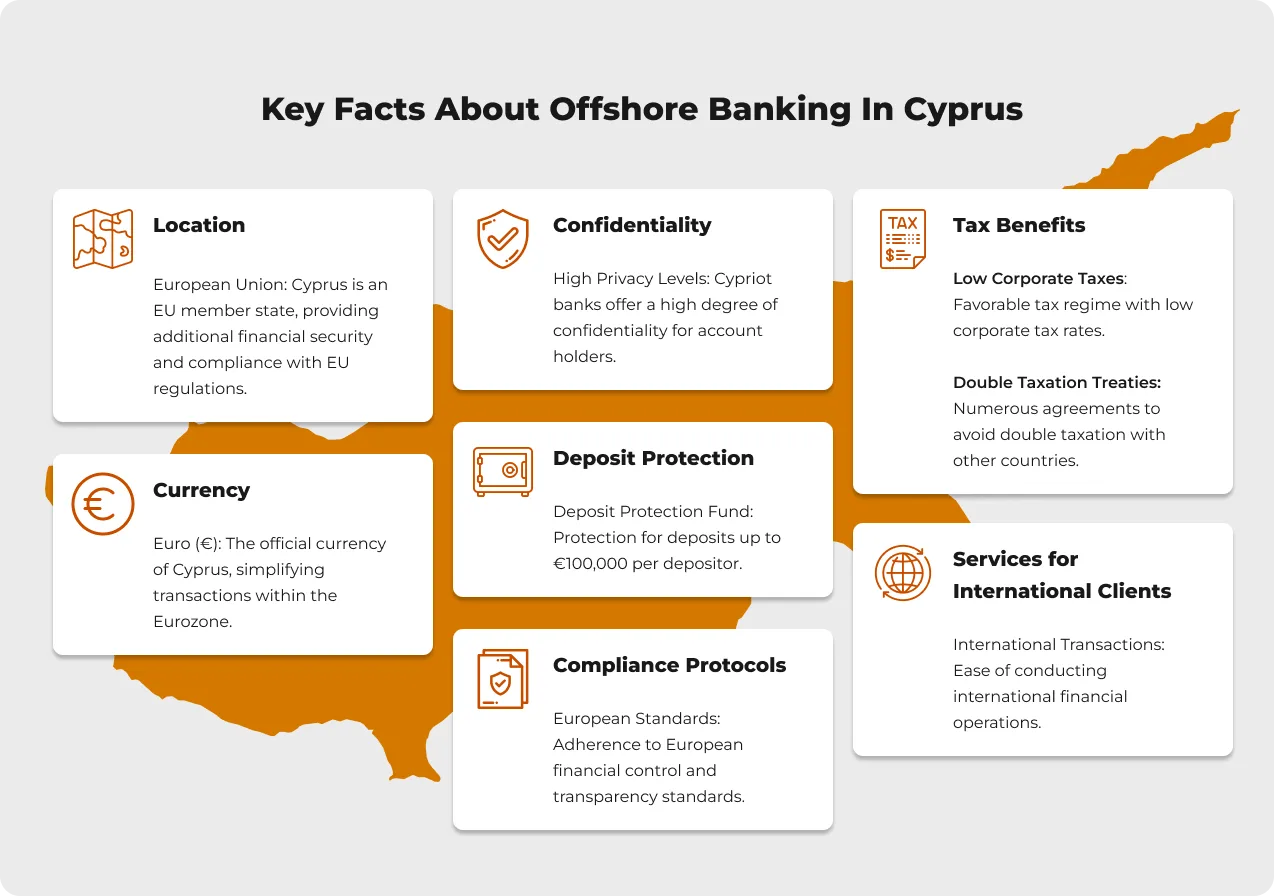

Key Facts About Offshore Banking In Cyprus

1. Location

- European Union: Cyprus is an EU member state, providing additional financial security and compliance with EU regulations.

2. Confidentiality

- High Privacy Levels: Cypriot banks offer a high degree of confidentiality for account holders.

3. Currency

- Euro (€): The official currency of Cyprus, simplifying transactions within the Eurozone.

4. Tax Benefits

- Low Corporate Taxes: Favorable tax regime with low corporate tax rates.

- Double Taxation Treaties: Numerous agreements to avoid double taxation with other countries.

5. Deposit Protection

- Deposit Protection Fund: Protection for deposits up to €100,000 per depositor.

6. Compliance Protocols

- European Standards: Adherence to European financial control and transparency standards.

7. Services for International Clients

- Internation

Benefits of Having a Cyprus Bank Account

Opening a bank account in Cyprus can offer several benefits:

- Access to EU Financial Services: Enjoy seamless transactions and banking services within the EU.

- Asset Protection: Cyprus provides robust legal frameworks for asset protection.

- International Transactions: Manage international transactions with multiple currencies easily.

- Business Opportunities: Facilitates easier business transactions and investments in Cyprus and abroad.

Requirements To Open A Cyprus Bank Account

To open a bank account in Cyprus, non-residents generally need to provide:

- Identification Documents: Passport or national ID.

- Proof of Address: Utility bill or bank statement from the past three months.

- Bank Reference: A letter from your current bank confirming your banking history.

- Source of Funds: Documents proving the source of your funds, such as employment contracts or business records.

- Business Documents (for corporate accounts): Articles of association, registration documents, and other documents proving the existence and operation of your company.

- Completed Application Form: Application forms from the chosen bank.

Open An Offshore Bank Account With Cyprus Banks

Several banks in Cyprus offer offshore banking services. Here’s a quick overview of popular options:

- Bank of Cyprus: The largest bank in Cyprus with a wide range of services.

- Hellenic Bank: The second-largest bank, offering a personalized approach to clients.

- Alpha Bank Cyprus: An international bank with a strong presence in Cyprus.

- Eurobank Cyprus: Another international bank offering comprehensive banking solutions.

Wise Business — Most Bank Account Details

Wise Business is a great option for businesses that deal with multiple currencies. They offer low fees for international transfers and a user-friendly online platform.

Revolut Business — Best For Distributed Teams

Revolut Business offers virtual and physical cards for team members, making it easy to manage expenses. They also offer integrations with popular accounting tools.

Multi-Currency Accounts

Many Cypriot banks offer multi-currency accounts, allowing you to hold funds in different currencies. This can be useful for diversifying assets and hedging against currency risks.

How To Transfer Money To A Cyprus Bank Account

Transferring money to a Cyprus bank account can be done through:

- Bank Wire Transfer: Directly from your bank account to the Cyprus bank.

- Online Payment Platforms: Services like PayPal or Wise for international transfers.

- International Money Transfer Services: Companies like Western Union or MoneyGram offer global transfer options.

Step-by-Step Guide to Opening a Cyprus Bank Account

- Choose a Bank: Research and select a bank that meets your needs.

- Prepare Documents: Gather all required documents, including identification, proof of address, and bank references.

- Submit Application: Fill out and submit the application form either online or in person.

- Account Verification: The bank will review your documents and verify your application.

- Deposit Funds: Make an initial deposit as required by the bank to activate your account.

Types of Bank Accounts Available

In Cyprus, you can open various types of accounts, including:

- Personal Accounts: For individual use, including savings and checking accounts.

- Business Accounts: For corporate entities and business operations.

- Multi-Currency Accounts: To manage multiple currencies in a single account.

Fees and Charges to Consider

Banks in Cyprus may charge various fees, such as:

- Account Maintenance Fees: Regular fees for keeping the account open.

- Transaction Fees: Charges for wire transfers or currency exchanges.

- Minimum Deposit Requirements: Some accounts may require a minimum balance.

Online Banking Services and Features

Most banks in Cyprus offer robust online banking services, including:

- Account Management: Access your account, check balances, and review transactions online.

- Mobile Banking: Manage your account via mobile apps.

- International Transfers: Send and receive money internationally with ease.

FAQ About Opening A Bank Account Online In Cyprus For Non-Residents

Can I open a bank account in Cyprus online?

Yes, many Cypriot banks allow you to open accounts online, though some may require an in-person visit for identity verification.

Can a foreigner open a bank account in Cyprus as a non-resident?

Yes, foreigners can open bank accounts in Cyprus even if they are not residents.

What is the procedure for foreigners to open a bank account in Cyprus?

The procedure is similar to that for residents, but additional documentation may be required to prove your residency abroad.

What are the requirements for opening a corporate bank account?

In addition to the standard documents, you will need company documents such as articles of association, registration documents, and financial statements.

Which bank is best for foreigners to open an account in Cyprus?

The best bank depends on your individual needs and preferences. It is recommended to compare the offerings of different banks before making a choice.

What is needed to open a bank account with the Bank of Cyprus?

Bank of Cyprus requires a standard set of documents, including identification, proof of address, and proof of income.

How much does opening a personal bank account in Cyprus cost?

The cost of opening an account varies depending on the bank and the type of account. Some banks may charge a monthly account maintenance fee.

How long does it take to open a bank account?

The account opening process usually takes from a few days to a few weeks, depending on the bank and the complexity of your application.

Can a foreign company open a bank account in Cyprus?

Yes, foreign companies can open bank accounts in Cyprus, but they will need to provide additional documents proving their registration and operation.

Why must I open an international bank account in Cyprus?

An international bank account in Cyprus can give you access to a wide range of financial services, protect your assets, and optimize your taxes

Note: Ensure you provide all required documents and information to avoid delays in opening your account.

References

- Double Taxation Treaties. Ministry of Finance. Accessed 29 March 2024.

- International. Bank of Cyprus. Accessed 29 March 2024.

- Business. Hellenic Bank. Accessed 29 March 2024.

- International. Alpha Bank. Accessed 29 March 2024.

- Deposit Protection Scheme. ACB. Accessed 29 March 2024.

- Documents. Bank of Cyprus. Accessed 29 March 2024.

- Video: How to Open a Bank Account in Cyprus

Looking for a reliable payment processing system?

Order selection of a payment solution