Step-by-Step Guide for Non-Residents: How to Register a Company in the UK

Company registration in the United Kingdom offers an attractive opportunity for international entrepreneurs due to its stable economy, business-friendly policies, and global reputation. Regardless of your location, this step-by-step guide will help you register a company in the UK, outline the key requirements, and address the specific considerations for non-residents.

Benefits of UK Company Registration

The United Kingdom represents an appealing destination for global entrepreneurs looking to establish themselves in Europe and worldwide markets. The rule of law, economic stability, and convenient access to international markets make it an excellent choice for non-residents wishing to expand their business operations.

Business Without Borders: Economic Advantages of UK Company Registration

The United Kingdom creates an exceptionally favorable environment for non-residents wanting to establish a business. Among the primary benefits is access to a stable economy, which serves as an excellent foundation for expansion. A company registered in the UK opens access to international markets, including the European Union (despite Brexit) and Commonwealth countries, thanks to robust trade networks.

The Legal Environment in the United Kingdom

The UK boasts a strong legal framework that ensures clear and predictable business regulations, minimizes risks, and enhances trust among partners and clients.

Global Reputation and Business Opportunities

Companies registered in the UK are widely recognized as reliable and reputable organizations, which significantly boosts their status in competitive markets. This strong reputation serves as a springboard for forming joint ventures with leading corporations, attracting investments from businesses seeking secure opportunities, and appealing to clients who value credibility.

Step-by-Step Guide to Company Registration in the United Kingdom

Registering a company in the UK as a non-resident involves a series of straightforward and transparent procedures.

Step 1: Choosing the Right Business Structure

The first crucial step is selecting the appropriate business structure. For most non-residents, the best option is a Private Limited Company (Ltd) due to its flexibility and the advantage of limited liability for shareholders. This structure ensures a clear separation between personal and business finances, protecting personal assets in case of financial difficulties.

A Limited Company also allows multiple shareholders, making it an attractive option if you plan to expand or seek investments. Alternative structures, such as a Public Limited Company (PLC) or a Limited Liability Partnership (LLP), may be suitable for specific cases but involve more complex regulatory requirements. To make the best decision, it is advisable to discuss your business goals with an industry expert.

Step 2: Choosing a Unique Company Name

Your company name is a crucial part of your brand identity and must comply with Companies House regulations.

Criteria for an Ideal Company Name:

– Uniqueness – The name must not already be registered.

– Clarity & Relevance – It should reflect your business mission and industry.

– Legal Compliance – No duplication of existing names.

– Restrictions on Certain Terms – Words like “Royal” or “Government” require special approval.

– Memorability – A simple, easy-to-remember name enhances brand recognition.

Before registering your company, check the name’s availability using the official Companies House service.

Your company name is the first impression for clients, partners, and investors. It plays a key role in shaping your brand’s reputation and marketing strategy.

Step 3: Preparing the Required Documents for Registration

To register your company, you need to prepare several key documents. The Memorandum of Association outlines the intent to establish the company and lists its initial subscribers (shareholders). The Articles of Association define the company’s internal rules, including decision-making processes and share distribution.

Additionally, you must provide details of at least one director, shareholders, and a registered office address in the UK.

Step 4: Registering Your Company Online or via an Agent

You can submit your application directly through the Companies House website or use a formation agent.

– Online registration typically takes 24-48 hours.

– Formation agents cost more but offer expert guidance and additional services, such as tax registration or setting up a registered office address.

For non-residents, working with an agent can be especially beneficial when handling the process remotely.

Step 5: Receiving Your Certificate of Incorporation

Once your application is approved, Companies House issues a Certificate of Incorporation, officially confirming your company’s legal status. This document includes your company name, registration date, and company number.

The certificate is essential for:

– Opening a corporate bank account

– Signing contracts

– Verifying your company’s legitimacy with partners.

“The UK market offers immense opportunities for international businesses, and we’ve helped numerous companies take this step. Transparent regulations, a prestigious jurisdiction, and access to global payment systems make the UK an attractive choice for entrepreneurs. Our experience shows that even complex cases can be resolved with the right approach.”

— Liubov Voitsekhovska,

CEO, Taxus Law & Finance

Key Requirements for UK Company Registration

Here’s what non-residents need to know.

Registered Office Address in the UK

Every UK company must have an official registered office address, which is used for receiving official correspondence, such as tax reminders. Non-residents without a physical presence in the UK can use a virtual office or registered address service to meet this requirement.

Information About Directors and Shareholders

You need at least one director, who can be a non-resident, along with details of all shareholders. Required information includes full names, addresses, and nationalities to ensure accuracy and avoid processing delays. Some company details are made publicly available via Companies House.

Memorandum and Articles of Association

These foundational documents are mandatory.

– Memorandum of Association – A formal statement of intent to establish the company.

– Articles of Association – A set of rules governing the company’s management and operations.

You can use standard templates provided by Companies House or tailor them with professional legal assistance to suit your business needs.

Costs and Fees for Registering a Company in the UK

Understanding the cost of registering a company in the UK is essential for planning and budgeting.

UK Company Registration Fees for 2025

As of 2025, online company registration through Companies House remains an affordable and cost-effective option. However, paper-based applications come with higher fees due to additional processing requirements. Depending on the chosen method and extra services, additional costs may apply.

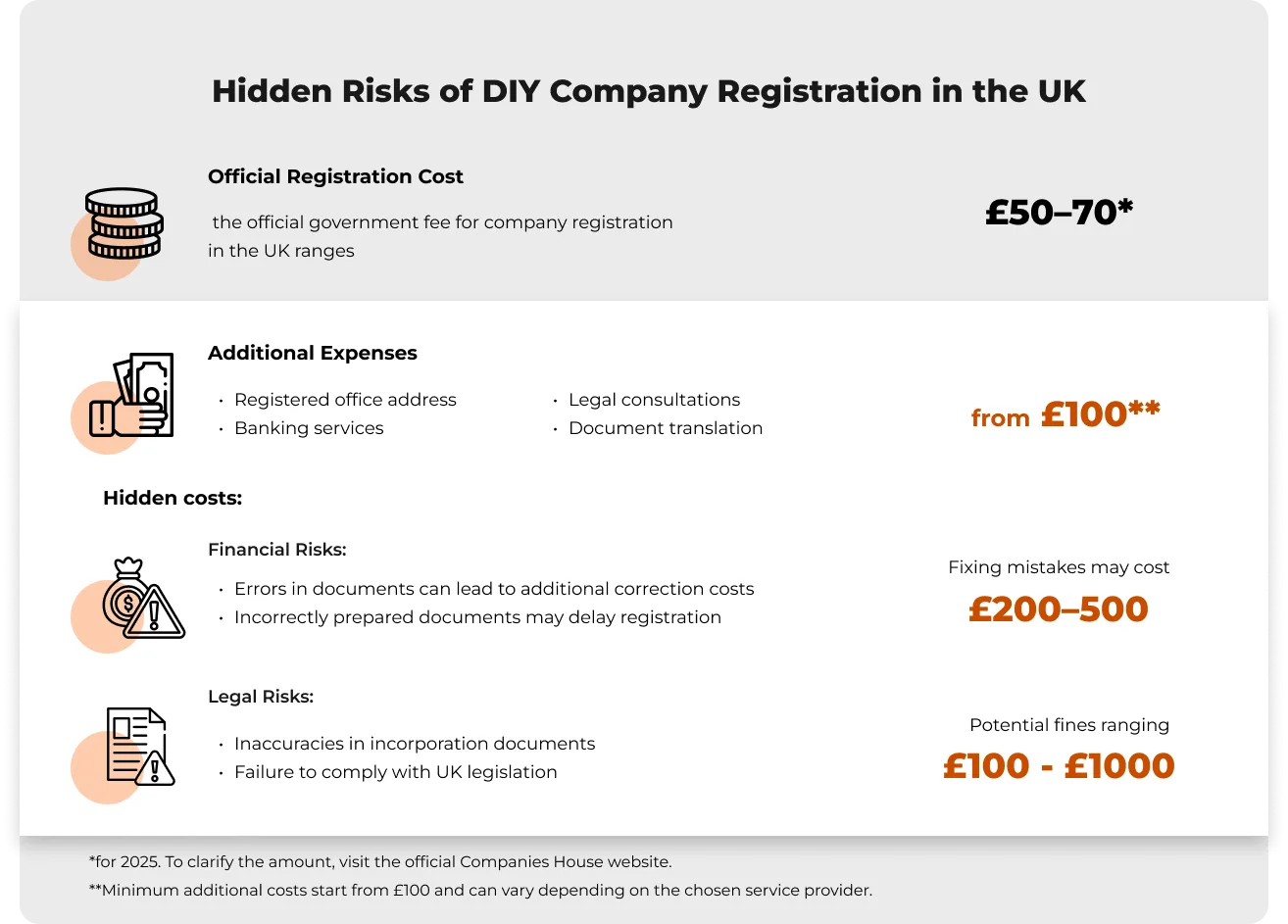

Official Registration Fees

As of 2025, the statutory fee for company registration ranges from £50 to £70. To confirm the exact amount, visit the official Companies House website.

While registering a company in the UK may seem straightforward, without professional support, you risk unexpected costs and bureaucratic hurdles.

Hidden Risks of DIY Registration

Financial Risks:

- Errors in documentation can lead to extra correction fees

- Incorrectly filed documents may delay registration

- Correction costs can range from £200 to £500

Legal Risks:

- Inaccuracies in incorporation documents

- Non-compliance with UK legislation

- Potential fines ranging from £100 to £1,000

For the most up-to-date fees, always check the Companies House website before submitting your application, as charges may change periodically.

Additional Costs

Beyond the standard company registration fee, foreign entrepreneurs may encounter additional expenses. For instance, the requirement for a registered office address often involves regular payments, which vary depending on the service provider and may include mail forwarding services.

The cost of opening a corporate bank account also varies depending on the chosen bank and account type.

If your company’s annual turnover exceeds the VAT threshold, VAT registration becomes mandatory, leading to extra administrative costs.

Additionally, non-residents may require legal or translation services, especially if document preparation or verification is needed to comply with UK standards.

How Long Does It Take to Register a Company in the UK?

Registering a company in the UK can be a quick and convenient process, especially when applying online. If you need a fast business launch, it’s essential to understand your options.

Standard Processing Time: Online vs. Paper Application

- Online registration via Companies House is the fastest and most efficient way to set up a company. If all documents are correctly prepared, the process typically takes 24 to 48 hours—an ideal option for entrepreneurs looking to start operations as soon as possible.

- Paper applications take longer, as documents are manually processed. This method usually requires 5 to 7 business days, so it’s important to factor this into your business timeline.

Expedited Registration Options

For businesses needing an urgent setup, Companies House offers same-day registration for an additional fee. If you submit your application before 11 AM, it may be processed and approved within 24 hours.

Company Registration in the UK for Non-Residents

Registering a company in the UK remains accessible to non-residents, offering international entrepreneurs favorable conditions for doing business. While the process is relatively straightforward, it’s crucial to consider key legal and regulatory requirements to ensure a smooth company setup.

Can I Set Up a UK Limited Company If I Live Outside the UK?

Physical presence in the UK is not required to register a company. However, there are essential requirements to meet:

- A registered UK address is mandatory for official correspondence and legal purposes.

- Company owners and directors must comply with UK corporate governance regulations to ensure proper business operations.

Opening a UK Business Bank Account as a Non-Resident

One of the main challenges for non-residents is opening a corporate bank account. UK banks follow strict anti-money laundering regulations, which can make the process more complex. To open a business account, you will typically need company registration documents, director identification, in some cases, proof of a UK address.

If traditional banks are not a viable option, there are alternative solutions—such as digital banking platforms that provide international business accounts with UK bank details. This allows companies to manage transactions efficiently without requiring a physical presence in the UK.

Verifying Your UK Company Registration

Once your company is successfully registered in the UK, it is essential to verify its official status and authenticity. This ensures trust among partners, clients, and regulatory authorities while guaranteeing compliance with legal requirements.

How to Check Your Company Registration Status

You can verify a registered company’s official status using the Companies House online service. Simply enter the company name or registration number to access up-to-date information on its activity and regulatory compliance.

Confirming the Registration Number

A company registration number (CRN) is a crucial identifier for all official business transactions. You can confirm its validity through the Companies House registry. A correct CRN validates the company’s legitimacy and is essential for contract signing, opening bank accounts, and conducting international business.

Regularly checking your company’s status helps avoid potential legal or financial risks and ensures smooth business operations in the UK.

Frequently Asked Questions (FAQ)

Can I register a company in the UK for free?

— No, company registration in the UK requires a mandatory fee payable to Companies House. The standard online registration fee is relatively low, while paper-based applications and expedited processing come at a higher cost. Additional expenses may arise for legal services, document preparation, and registered office rental.

What Is the Difference Between Online and Offline Registration?

— Online registration is the fastest and most convenient option, typically taking 24–48 hours if all documents are correctly submitted. Offline registration involves paper-based application submission and manual processing, which can take 5 to 7 working days. Additionally, online applications reduce the risk of errors due to automatic validation checks before submission.

Is a VAT number required for company registration in the UK?

— No, obtaining a VAT number is not mandatory for company registration in the UK. However, if your annual turnover exceeds the threshold (currently £90,000), VAT registration becomes compulsory. Businesses can also opt for voluntary VAT registration, which allows reclaiming VAT on business expenses, enhances credibility with partners, and may simplify tax procedures if rapid growth is expected.

Can I Register a UK Company from India, Pakistan, or Other Countries?

— Physical presence in the UK is not required to register a company. However, there are essential requirements to meet:

- A registered UK address is mandatory for official correspondence and legal purposes.

- Company owners and directors must comply with UK corporate governance regulations to ensure proper business operations.

The registration process for non-residents is almost identical to the standard procedure. Regardless of your place of residence, you will need to submit the required incorporation documents, including the Memorandum and Articles of Association. It’s essential to ensure in advance that your company’s structure and details comply with UK legal requirements.

Looking for a reliable payment processing system?

Order selection of a payment solution.