About me

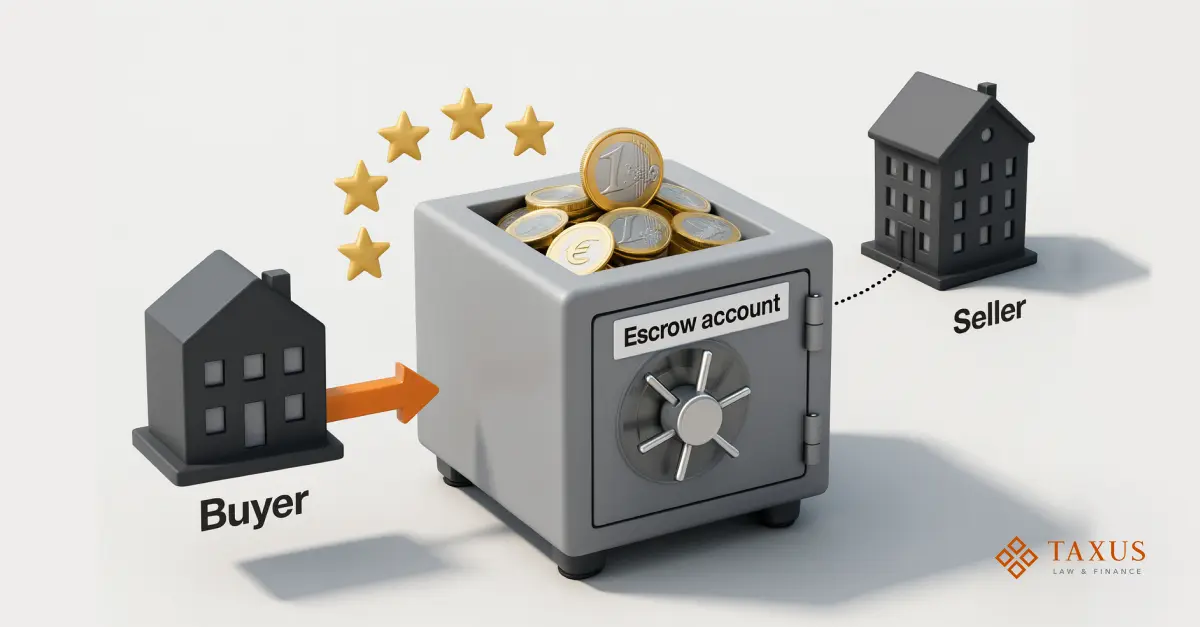

Hi! I work as a Payments Manager at Taxus Law & Finance, and my job is to make complex financial processes clear and efficient. Every day I help clients accept payments worldwide quickly and securely.

If you are a business that wants to streamline payment flows and open accounts in different jurisdictions, I become your guide. My legal background helps me solve complex tasks in financial operations and regulatory compliance. I enjoy finding simple and effective solutions — for example, configuring payment systems that save clients’ time and resources.

Focus: EMI/PSP onboarding • Business & merchant accounts • KYC/AML basics • APM/Open Banking

Mission and vision. I want every Taxus Law & Finance client to feel that financial processes with us are reliable, transparent and beneficial. Behind complex terminology there are always people and their needs, and my goal is to make the complex simple.

Experience

- Payments Manager, Taxus Law & Finance (present)

- Advocate’s Assistant — civil, criminal, administrative and family law

Certificates & Training

- Bachelor of Law, Yaroslav Mudryi National Law University (Advocacy Faculty)

FAQs

Q: How long does it take to open a corporate account?

A: The timeline depends on the jurisdiction, business model, risk level, and the provider. EMI accounts typically take 7–15 business days (provided that the full document package is submitted). Banks generally take longer and conduct more selective onboarding — from 3 to 8 weeks, and usually require confirmed substance in the jurisdiction.

Q: What increases the chances of getting a merchant account approved?

A: A clear description of the business model, transparent source of funds, valid KYC/KYB and proof of economic presence (substance) in the chosen jurisdiction. See the Banking & Payments section for more details. .

Need a working payment infrastructure without unnecessary stops?