Escrow account: how the conditional holding of funds works

What is escrow and why do you need it?

In the modern economy, where a significant share of transactions takes place between parties with no previous history of working together, trust becomes decisive.

When it comes to buying a business, real estate or implementing large-scale IT projects, both parties want guarantees. The seller wants to be sure they will receive payment after they have fulfilled their obligations. The buyer, in turn, needs protection from the risk of sending funds in a situation where the deal is not completed or its terms are not complied with.

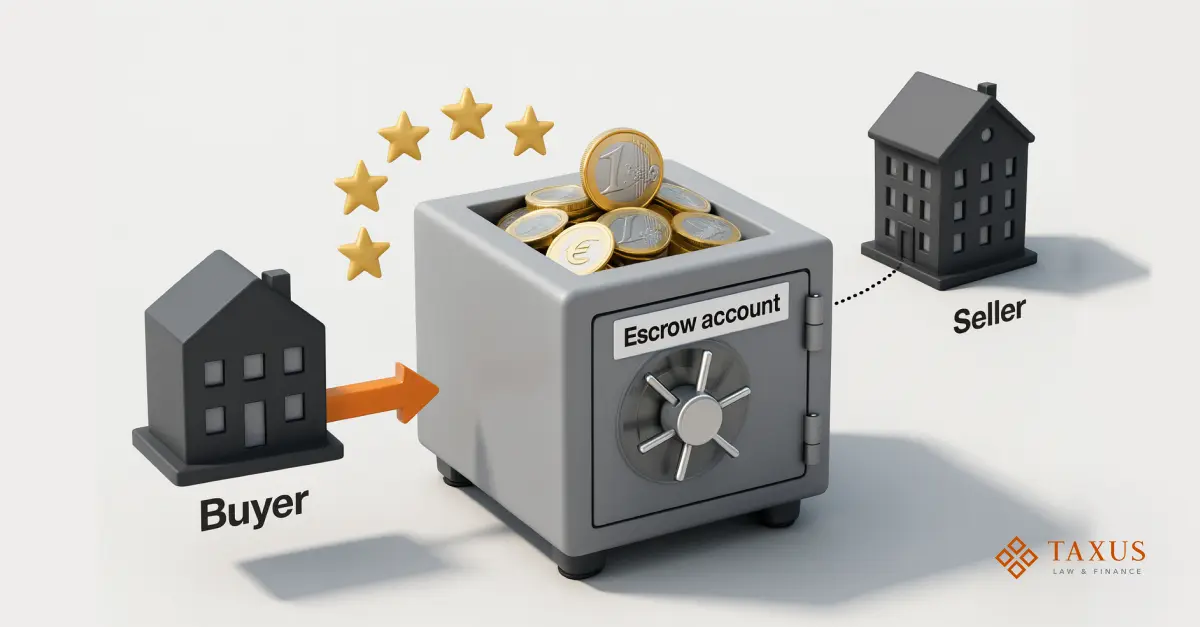

An escrow account is a mechanism that allows funds to be temporarily placed in a neutral bank or payment account until specific conditions agreed between the parties are fulfilled. The money does not go directly from the buyer to the seller but is held by a third party – the escrow agent.

Such an agent can be a bank, a notary or a licensed financial institution. Their role is to hold the funds until all contractual obligations are fulfilled and then either transfer the money to the seller or return it to the buyer, depending on the outcome of the transaction.

Escrow creates a balance of interests between the parties by acting as a financial buffer that minimises the risk of non-performance:

- for the seller – a guarantee that the funds will be paid out once the conditions are met;

- for the buyer – protection from premature payment if the conditions are not met;

- for both parties – a transparent control mechanism and a neutral intermediary.

How does the escrow mechanism work?

The mechanism of conditional holding of funds can be imagined as a financial “safe” that opens only when each party has fulfilled its part of the obligations.

- Signing the agreement.

The parties agree on and record in the contract the conditions under which the funds must be transferred to the seller or returned to the buyer. These conditions may include:

- transfer of ownership;

- signing of completion certificates;

- completion of specific project milestones, etc.

- Funding the escrow account.

The buyer transfers the agreed amount to a specially opened escrow account.

- “Freezing” the funds.

Until the conditions of the deal are fulfilled, the funds remain in the escrow account and are not available to any of the parties.

- Confirmation that the conditions are met.

The escrow agent receives confirmation that the contractual conditions have been fulfilled. This confirmation may be:

- documentary (for example, notarised);

- electronic – if this is provided for in the contract.

- Settlement under the transaction.

- If the conditions are fulfilled, the money is transferred to the seller’s account.

- If the conditions are not fulfilled, the funds are returned to the buyer.

In this way, escrow not only guarantees financial security but also creates a transparent mechanism for controlling the execution of the transaction.

Escrow for your project – end-to-end support

Who can act as an escrow agent in the European Union?

In EU countries, escrow services are subject to clear legal requirements because they involve handling funds that belong to third parties. In most jurisdictions, escrow agents can only be financially stable and licensed institutions.

Most often, escrow agents are:

- banks – especially in large M&A transactions, construction finance or commercial real-estate deals;

- notaries and lawyers – in private transactions where the legal element is critical;

- licensed payment institutions and electronic money institutions (Payment Institution, EMI) – with the ability to open escrow accounts online in accordance with regulatory requirements.

In some countries – in particular Germany, the Netherlands and Luxembourg – the escrow mechanism is integrated into the banking system at the legislative level. This provides a high level of control, transparency of operations and compliance with EU financial regulatory standards.

Where is escrow used in practice?

The escrow mechanism is used in various sectors of the economy where there is a need for financial guarantees and risk minimization in business transactions.

Business and asset purchase deals

In business or asset purchase deals, an escrow account for M&A transactions is used to hold part of the deal value until:

- legal checks (due diligence) are completed;

- financial indicators are agreed;

- the integration period is finished.

This allows the parties to avoid misunderstandings and supports transparent negotiations.

Construction and real estate

In the construction sector, escrow accounts are used to protect the funds of investors and home buyers. In many EU countries:

- the use of escrow is required by the regulator or the bank financing the project;

- Investors’ funds are released to the developer only after confirmation of the project’s readiness.

This significantly reduces the risk of unfinished projects and protects end buyers.

IT sector and transfer of intellectual property rights

In the IT sector and in IP transfer deals, escrow allows the transfer of source code, technology, and software licences to be aligned with the timing of payment. This is particularly important for international IT contracts, where the parties operate in different legal systems and have no previous history of cooperation.

International B2B trade

In international trade, escrow is a trust instrument for large B2B transactions. In such cases:

- the parties may be located in different countries;

- there is often no track record of cooperation;

- both sides need guarantees that each party will fully perform its obligations.

Learn more about building banking infrastructure and payment solutions for IT and e-commerce on our “Banking & Payments” service page.

Legal aspects and security of escrow transactions

Escrow is a financial instrument that combines the flexibility of a private contract with a high level of regulatory oversight. Its main advantage is clear legal certainty: all actions of the escrow agent are strictly limited by the conditions agreed between the parties.

Within the EU, the use of escrow accounts is often subject to:

- PSD2 (Payment Services Directive) – where the service is provided by a payment institution;

- AML requirements (anti-money laundering) – standards for preventing money laundering and terrorist financing;

- KYC requirements (know your customer) – verification of the parties, sources of funds and ultimate beneficial owners;

- GDPR – data protection rules governing the processing of information in escrow operations.

Thanks to this combination of requirements, an escrow account provides a high level of transaction security while maintaining flexibility and adaptability to the specific terms of each deal.

For a deeper dive into the role of safeguarding accounts in payment infrastructure, see our article “Safeguarding accounts: your key to financial security in 2025”.

Examples from EU practice

Germany

In Germany, banks actively use escrow accounts when buying commercial real estate. The buyer’s funds remain in a separate escrow account until changes are registered in the land register, which completely eliminates the risk of a double sale.

France

In France, notaries act as escrow agents in inheritance, corporate, and family transactions, ensuring legal oversight of compliance with contractual terms.

Netherlands

In the Netherlands, venture investors often use escrow to hold funds until the final Share Purchase Agreement (SPA) for a stake in a startup is signed.

Estonia

In Estonia, fintech companies have created fully digital escrow solutions for international deals between freelancers and clients. This makes it possible to carry out transactions in real time without the involvement of traditional banks.

Escrow + contracts: how to protect your deal in the EU

The future of escrow mechanisms

Developments in the financial market point to a shift towards digital escrow solutions. Online platforms make it possible to create deals, sign documents, and perform contractual conditions without the physical presence of the parties.

With the introduction of open banking technologies, electronic signatures, and smart contracts, the process becomes more automated and faster. Such solutions are particularly relevant for international transactions, where speed and transparency of settlements are critical.

Conclusion

Escrow is an effective tool for managing financial risks that ensures a balance of interests between the parties, transparency of the process and legal certainty.

In European practice, this mechanism has long been a standard for:

- large corporate deals;

- construction and real-estate projects;

- digital and cross-border transactions.

Using an escrow account not only increases the security of settlements but also demonstrates a professional approach to managing financial processes, where trust, control and compliance with EU legal standards remain key.

Looking for a reliable payment processing system?

Order selection of a payment solution.