The role of a Payment Manager: How an Expert helps You open Business Accounts faster and safer (2025)

V. Hladush

In the previous articles of this series Why Your Business Account application might be rejected in 2025–2026: 13 Common Mistakes to Avoid, we explored the most common mistakes that complicate the process of opening a business account. Now, let’s talk about the experts who help businesses avoid these pitfalls — payment managers.

Discover what a payment manager does, how their role differs from that of a lawyer, and why specialized experts can make the account opening process much simpler and safer.

Who is a “payment manager” and why it’s not just a lawyer

Many clients ask, “Why can’t I just have my lawyer do this?” The roles are complementary but distinct:

- Tasks of a payment manager: We do deep business analysis of the client profile. We select realistic providers (based on industry and compliance comfort). We prepare the client memo, flow diagrams, and cover letters targeted at each provider. We negotiate with the provider’s onboarding team and provide post-approval support (helping manage limits, compliance, transaction issues).

- Legal advisor’s role: The lawyer usually handles contract/legal drafting (agreements, licensing questions, terms of service). A lawyer might also vet AML documents, but typically at a high level. However, banks rarely hire just a lawyer’s brief. They need someone who speaks payments, understands routing rules (SWIFT/BIC vs. SEPA vs. RTGS), can handle transaction test files, API integrations (for BaaS or open banking), etc. That’s a payment manager’s domain.

- Client benefits: Working with a payment expert can shave 1–2 months off the timeline. Clients get a sustainable payment landscape – not just one account, but a roadmap (e.g. “start with Provider A for EUR, Provider B for USD, then add crypto module with C”). It also reduces account blocks: with proper management, banks see fewer surprise high-risk transactions. And good onboarding raises your “business” rating with providers (good records mean faster approvals next time).

In short, a payment manager is part strategist, part project manager, part compliance specialist. We bridge the gap between the business and the technical/compliance team at the provider.

FAQ highlights

- Cost: Our fees vary by case complexity but are usually justified by the time saved. Many clients find that fast approval with the right solution is worth the consultant fee.

- Lawyer vs. payment manager: Lawyers are essential for contracts and formalities. A payment manager, however, focuses on onboarding and operations – tasks lawyers often don’t cover. We sometimes work alongside legal teams (having the client’s counsel on speed-dial to clear any legal questions from the bank).

- “Why not just apply and wait?”: Because without preparation, banks will inevitably have too many unanswered questions. Meanwhile, time is wasted. Having an expert guide the process means no surprises and quicker resolution of any issues.

Toolkit

To give clients a head start, we often provide templates and checklists, such as:

- KYC checklist: A list of all documents (IDs, incorporations, contracts, bank statements, AML policies, etc.) needed by banks.

- Client profile template: A structured summary of ownership, business model, products, key markets and clients, license status, etc.

- Turnover logic/P&L model: A spreadsheet outlining how many customers, at what price and frequency, generate the proposed revenue.

- Pitch email/cover letter: A professional letter that introduces the company to the provider, highlighting the positives and summarizing why it’s a good fit.

- Transaction mapping diagram: A visual flow of money (e.g. Customer → Service → Merchant → Bank) to illustrate the exact flow of funds, making it easy for a compliance officer to follow.

These tools streamline future cases as well. Once a company has a solid client profile and KYC packet, adding a new account (or a new country, or a new product) becomes much faster.

Payment Partners Network Development at Taxus

The past two years at Taxus have been dedicated to expanding our network of payment partners and supporting services for clients:

- Doubling Provider Pool: The number of partners among BaaS, PSP, and EMI providers has doubled. Our network now includes global players such as Gemba, Genome, BVNK, MultiPass, Satchel Pay, Payset, Payswix, Verifo, RagaPay, SH Financial, Payoneer, and others.

- Strategic Partnerships: Direct communications have been established with numerous providers. For instance, we standardized agreements and KYC requirements with certain EMIs (Genome, Payset), accelerating new onboarding cases. FAQs have been created for each partner, enhancing collaboration between providers’ onboarding teams and clients.

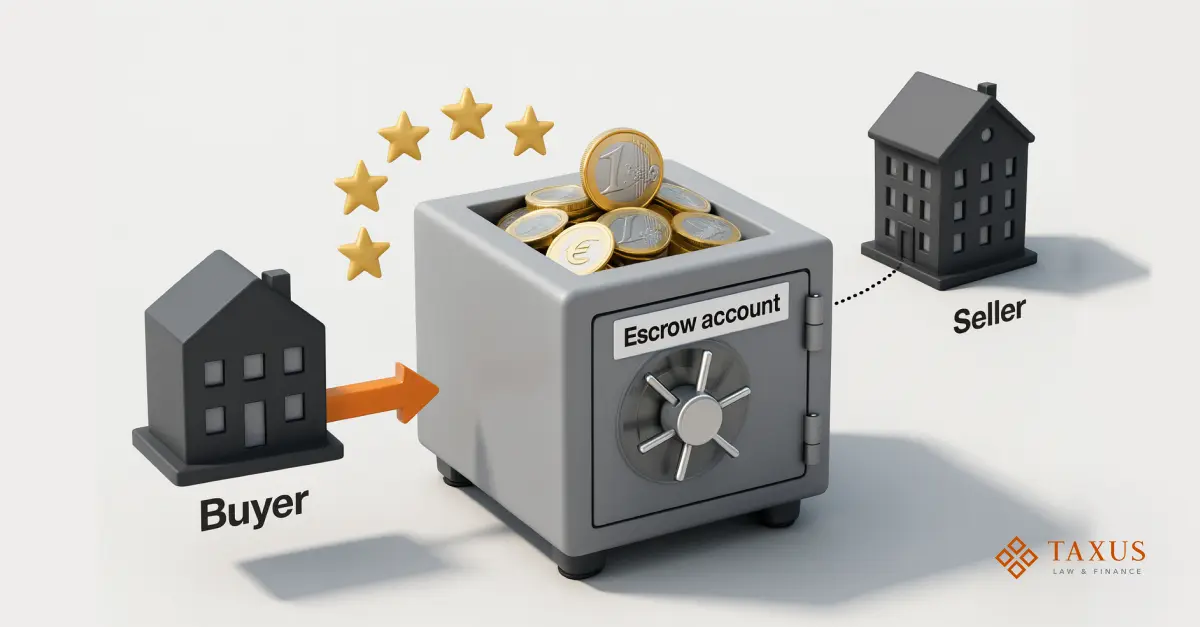

- Reserve and Trust Accounts: Solutions have been developed for larger clients to establish escrow or trust accounts (for merchant payment aggregation) and structured insurance policies to safeguard client funds.

- API/BaaS Integrations: For technically savvy clients, integration with BaaS APIs (such as BVNK or Payoneer API) is recommended, allowing the payment layer to scale alongside business growth without being limited to a single account.

Building such a partnership network directly addresses the evolving needs of modern businesses. A single account is no longer sufficient—an entire ecosystem is required. For example, a client might open a EUR account with one EMI while simultaneously requiring integration with Apple/Google Pay and FX services for USD. This approach ensures each client’s request receives a tailored infrastructure solution.

Consequently, when clients approach with specific requests, we don’t simply “search for any provider”—we construct the right solution. This brokerage approach, rather than a “one-size-fits-all” model, has become a significant competitive advantage for us.

Conclusion:

Today, the role of a payment manager extends far beyond simply “assisting in account opening.” They are experts who help businesses build resilient payment infrastructures, ensure regulatory compliance, and prevent critical errors. At Taxus, our strategic vision combined with practical experience helps businesses effectively and safely scale their payment capabilities.

Looking for a reliable payment processing system?

Order selection of a payment solution.