Benefits of Cyprus Company Incorporation

If you are looking for a jurisdiction for quick and convenient business registration, you should consider Cyprus. Thanks to its strategic geographical location, Cyprus provides access to key markets in Europe, Asia, and Africa. This makes Cyprus an ideal location for international operations and supply chains.

Cyprus is popular among entrepreneurs due to its attractive tax policies, the simplicity of the company registration process, and favorable investment conditions. Registering a company in Cyprus is an ideal option for entrepreneurs seeking international recognition and preferential conditions for conducting business.

By registering a company in Cyprus, you can reduce costs without compromising quality. Around a thousand new companies are established here every month. A key factor for success is the advantageous tax system, specifically designed for businesses. In addition to registering a new company, it is also possible to relocate an existing business from another country to Cyprus through the process of redomiciliation.

Over the past thirty years, Cyprus has become a key hub for international companies seeking favorable conditions for investment and business expansion. In recent years, many companies have chosen Cyprus as the location for their headquarters.

It is worth noting that Cyprus has abolished the annual company tax. The annual company tax was introduced in Cyprus during the financial crisis of 2013. Through this levy, the government collected around 50 million euros annually in company taxes.

On February 29, 2024, a session of the Parliament in Cyprus resulted in a decision to completely abolish the annual company levy. The contribution of 350 euros was required to be paid by all companies registered in Cyprus to the state budget no later than June 30 each year, regardless of whether they were conducting any activities or owned any assets.

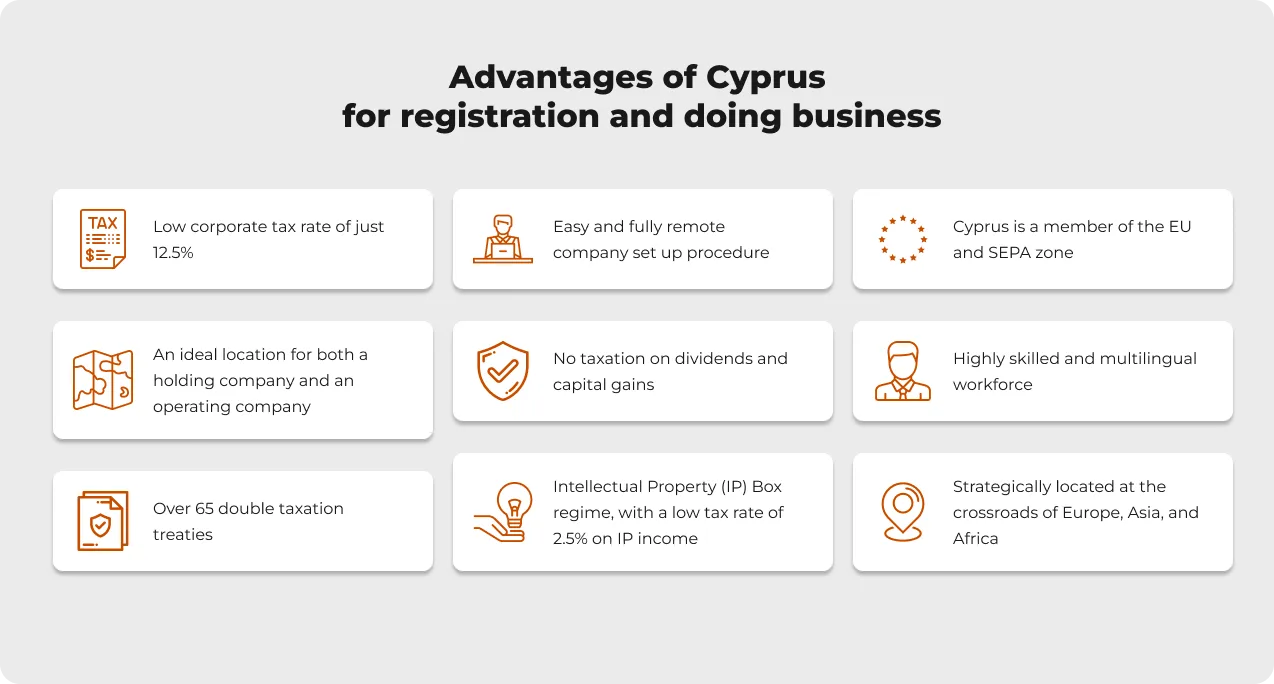

We have highlighted several key benefits of this country for business registration and operation. The decision to establish a business in Cyprus is supported by a number of undeniable benefits, such as:

Attractive Tax System

Cyprus is renowned for its attractive tax system, offering a range of benefits for businesses and investors.

Management and Control

If a company is established in Cyprus, and its management and control are exercised from Cyprus, it will be taxed on both income earned in Cyprus and income earned abroad.

Low Corporate Tax

Cypriot companies are subject to a corporate tax rate of only 12.5%, one of the lowest in Europe. This makes Cyprus an appealing destination for businesses seeking to reduce their tax obligations.

For companies that are not residents of Cyprus, taxes are levied only on income earned within the country.

Tax Rates:

- Corporate tax (income tax for legal entities) is 12.5%.

- Value-added tax (VAT) is 19% (9% for certain goods and services).

- Dividend tax is not levied on legal entities.

Double tax treaties

Cyprus has concluded double taxation treaties with more than 60 countries. These treaties enable citizens of other countries to benefit from the low tax rates applicable in Cyprus and prevent double taxation.

Simplified registration procedure

Company registration in Cyprus is relatively simple and fast. No minimum authorized capital is required.

There is no need for your presence during the company registration process, you can register a company in Cyprus remotely.

In addition, most businesses operating in Cyprus use English as their working language. Thus, you will not have any language barriers.

Favorable business climate

Cyprus has a developed infrastructure, a stable legal system and access to international markets.

Geographical location

Cyprus is located at the crossroads of Europe, Asia and Africa, making it strategically important for businesses looking to expand into different markets.

A wide range of investment opportunities

Cyprus is an optimal location for a variety of investments, offering the opportunity to invest in various sectors with high profit potential. You can find profitable areas such as tourism and hospitality, residential and commercial real estate, information technology and innovation, energy, shipping and logistics. The local market is developing dynamically, providing investors with access to a wide range of promising projects and lucrative investment opportunities.

Confidentiality and anonymity

The laws of Cyprus provide a high level of confidentiality for the beneficial owners of companies.

Flexibility in management

A Cyprus company can be managed from abroad, and its operation does not require the presence of a director or shareholder in Cyprus.

Financial support for start-ups and innovative companies

Cyprus provides various financial support programs, including subsidies, soft loans and tax incentives.

Relocation of employees to Cyprus

Cyprus offers an attractive value proposition for businesses and multinationals, offering low start-up costs, affordable office rents and competitive commercial real estate prices. The surge in interest has led to a proliferation of mixed-use office and commercial projects in key business centers such as Limassol and Nicosia. Foreigners have the right to establish an international company in Cyprus that can employ non-EU nationals in Cyprus. Such a company can obtain a work permit for the relevant employees and a residence permit for them and their family members.

Professional services sector

Cyprus boasts a competitive, cost-effective and highly skilled professional services sector and is well versed in handling complex multi-jurisdictional transactions for international companies. Major international accounting firms have a presence in Cyprus, and law firms have partnered with leading global law firms to provide comprehensive legal support. Cyprus’ commitment to international tax standards, transparent practices and skilled professional workforce further strengthen its position as an attractive destination for businesses seeking a favorable and profitable environment for growth and expansion.

In conclusion, it is worth noting that Cyprus is not blacklisted by the OECD (Organization for Economic Cooperation and Development), which guarantees your business legal operations in a reputable jurisdiction. In addition, Cyprus is not only a convenient place to work, but also to live. English is widely used in all spheres, there is a large international community, foreign schools for children, and modern real estate for every budget. As already mentioned, the tax environment on the island is one of the most favorable in Europe. Resident companies pay a corporate tax of 12.5% of their profits, regardless of the source of their income. Cyprus is known for its desire to create special conditions for certain business sectors. In particular, IT professionals benefit from the special IP BOX regime, which allows them to reduce the effective tax rate to 2.5% under certain conditions.

Cyprus offers many benefits for international companies planning to set up or expand their business, providing cost-effectiveness, a friendly environment and government support.

Looking for a reliable payment processing system?

Order selection of a payment solution